Articles by Montoya Wealth

Our fee-only investment advice and comprehensive financial planning is aimed at ensuring peace of mind as you head into your retirement years. We wrote the following articles with that in mind.

Recent articles

Montoya Wealth Management was voted Best Financial Planner by Market Surveys of America. Along with the nifty plaque, we’re grateful for the faith our customers place in us. Thank you!

Occasionally Prescott punches above its weight, bringing a celebrity or top musician to live among us.

Take the case of Jack Petersen. Jack likes jazz and plays the guitar. Which is to say, in the early 1960s he developed the jazz-guitar program at the Berklee College of Music (the Yale of music schools) and subsequently went on to even greater things in the world of jazz.

In March, as the world was in the throes of a new pandemic, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The law, one of the few bright spots of those early months, helped Americans impacted by the COVID-19 pandemic.

This spring has brought many unprecedented changes. With jobs on hold or lost, and small businesses in limbo, the Internal Revenue Service has reset the federal tax deadline to July 15. This means you have until July 15 to file your 1040 form, pay any federal taxes owed for 2019, and make contributions to your HSA and IRA accounts.

Here in the retirement planning world, the December passage SECURE Act has been a pretty big deal. This isn’t surprising given that the bill was intended to help more Americans benefit from various retirement vehicles, including Individual Retirement Accounts (IRAs).

One of the greatest legacies any parent can give a child is a framework for living an enduring, healthy lifestyle. In fact, it’s nearly impossible to underestimate the power that parents have on their children’s development, which is why parenting is such a profound responsibility.

Creating a successful financial legacy isn’t just about leaving money to kids and grandkids; it’s also about the financial tools and skills you help them develop along the way.

You may be hearing a lot of buzz about exchange-traded funds (ETFs). With their very low charges and management fees, ETFs give you a cheap and convenient way to build a portfolio of index funds.

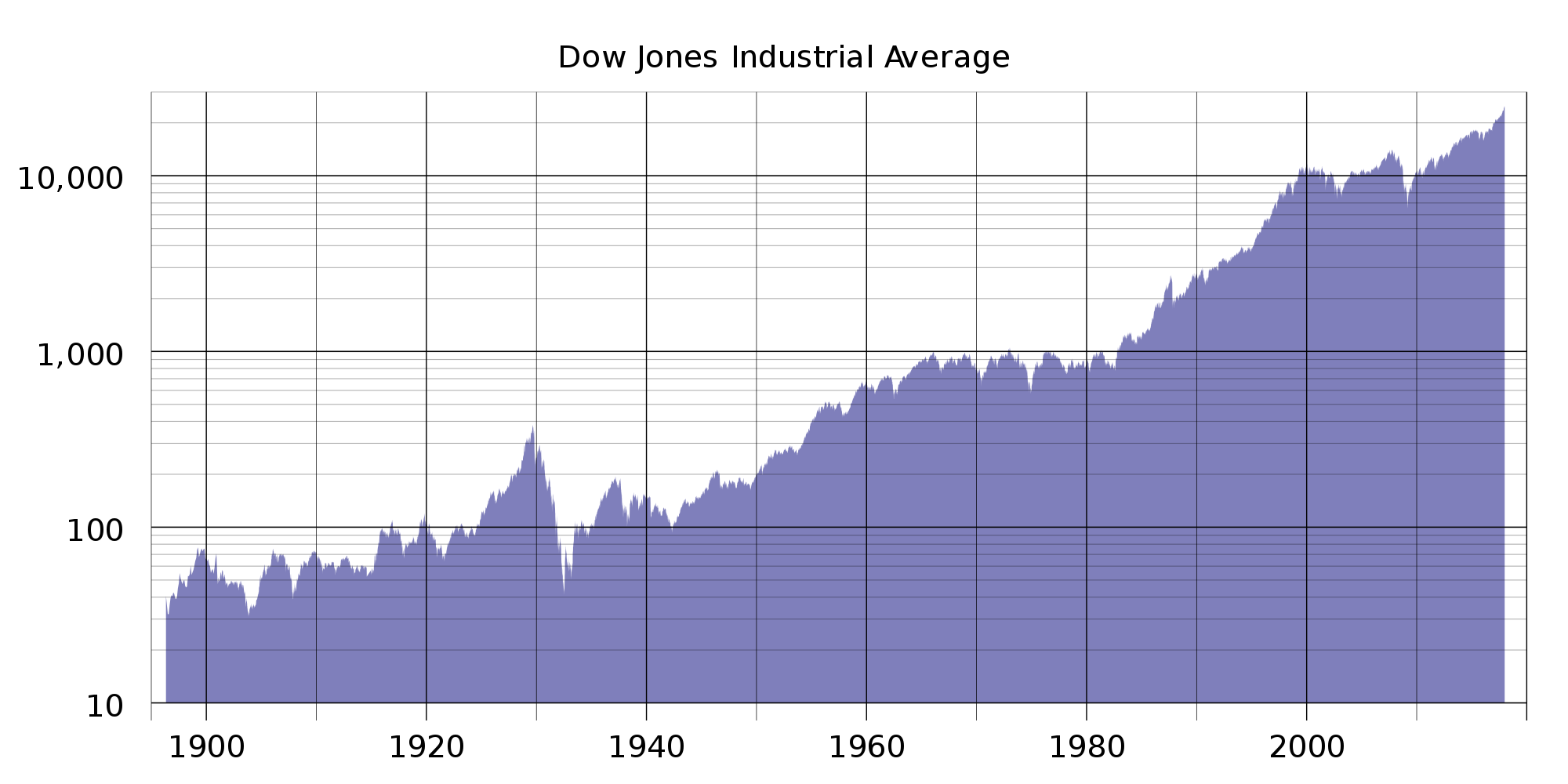

On the news of escalating trade tensions with China, volatility has once again returned to the market, and along with it, investor alarm. So what’s the right thing to do? The truth is, there’s no pat answer to that question. But there is one thing I can tell you that applies to anyone: It’s important to proceed thoughtfully and carefully.

Knowledge is power and that’s why Montoya Wealth is now offering a convenient way for our clients to stay on top of their finances, even when they’re on the go. View the video to learn more.

If you aren’t working with a financial planner or you don’t have the time to do a full plan right now, you can follow these steps to keep your finances in pretty darn good shape.

We feel so strongly about the importance of operating as a fiduciary, in fact, that when we organized our business, we did so as a fee-only registered investment advisor, a business type required by law to practice as a fiduciary. We are also avid followers of legal news about financial fiduciaries.Of late, there’s been plenty to follow.

Wall Street may be turbulent, but you can stay calm. You could even look at this as a buying opportunity. Assuming this is a correction and nothing more, the market may regain its footing more quickly than we think.

Ann Sult is a mother and a grandma, but still, she’s not yet done giving birth. Her other children are grown and her official retirement date is four years past, but still. It’s just that these days, what she labors over isn’t flesh and blood, but paintings.

If your retirement dream is to sip a French roast coffee and savor a baguette from a sidewalk shop on the Champ Elysees peering at the Eiffel Tower, Brandon Montoya would welcome a postcard.

The transition from career to retirement can offer a welcome opportunity for retirees to follow their bliss. But it can also leave people adrift without their routines, social networks, and workplace identities. Here are several questions you can ask yourself to navigate the pitfalls and opportunities of retirement and create an ideal-for-you post-career life.

A friend of ours, Deborah, recently lost her husband after a long illness. During the weeks and months leading up to his passing, Deborah took care of Jim. It wasn’t until after the funeral that she gave much thought about what living alone would mean.

As you head into retirement, it’s a good idea to start thinking about how you plan to manage the tax consequences of accessing your nest egg. Instead of allowing IRS rules to be your default tax strategy, it may be worth looking at whether converting some part of your traditional IRA to a Roth IRA will allow you to come out ahead.

Read all of our articles here.

Living well in retirement

One of the greatest legacies any parent can give a child is a framework for living an enduring, healthy lifestyle. In fact, it’s nearly impossible to underestimate the power that parents have on their children’s development, which is why parenting is such a profound responsibility.

Creating a successful financial legacy isn’t just about leaving money to kids and grandkids; it’s also about the financial tools and skills you help them develop along the way.

Ann Sult is a mother and a grandma, but still, she’s not yet done giving birth. Her other children are grown and her official retirement date is four years past, but still. It’s just that these days, what she labors over isn’t flesh and blood, but paintings.

If your retirement dream is to sip a French roast coffee and savor a baguette from a sidewalk shop on the Champ Elysees peering at the Eiffel Tower, Brandon Montoya would welcome a postcard.

The transition from career to retirement can offer a welcome opportunity for retirees to follow their bliss. But it can also leave people adrift without their routines, social networks, and workplace identities. Here are several questions you can ask yourself to navigate the pitfalls and opportunities of retirement and create an ideal-for-you post-career life.

A friend of ours, Deborah, recently lost her husband after a long illness. During the weeks and months leading up to his passing, Deborah took care of Jim. It wasn’t until after the funeral that she gave much thought about what living alone would mean.

Read all of our articles here.

Articles on tax and investment strategies

Here in the retirement planning world, the December passage SECURE Act has been a pretty big deal. This isn’t surprising given that the bill was intended to help more Americans benefit from various retirement vehicles, including Individual Retirement Accounts (IRAs).

As you head into retirement, it’s a good idea to start thinking about how you plan to manage the tax consequences of accessing your nest egg. Instead of allowing IRS rules to be your default tax strategy, it may be worth looking at whether converting some part of your traditional IRA to a Roth IRA will allow you to come out ahead.

Some myths & misperceptions keep circulating about Social Security. These are worth dispelling, as more and more baby boomers are becoming eligible for their retirement benefits.

What is risk? To the conservative investor, risk is a negative. To the opportunistic investor, risk is a factor to tolerate and accept. Whatever the perception of risk, it should not be confused with volatility. That confusion occurs much too frequently.

Times have changed – and so have financial advisors. Today, people don’t want financial advice from a salesman. Instead, they want a relationship with a financial professional who is candid, trustworthy and thoroughly educated, and who provides personalized financial consulting for each client.

Year after year, in bull and bear markets, investors make some all-too-common blunders. They have been written about, talked about, and critiqued at some length – and yet they are still made. You can chalk them up to psychology, human nature, perhaps even a degree of peer pressure. You just don’t want to find yourself making them more than once.

One of the world’s most heralded investors simply keeps calm and carries on.

If you ask someone who the “world’s greatest investor” is, the answer more often than not may be “Warren Buffett.” That honor has never formally been awarded to him, and many other names might be in the running for that hypothetical title, but one thing is certain: the “Oracle of Omaha” is greatly admired in investing circles.

Read all of our articles here.

Articles on financial planning

If you aren’t working with a financial planner or you don’t have the time to do a full plan right now, you can follow these steps to keep your finances in pretty darn good shape.